Econ 101: What happens to an asset or good’s price when new supply decreases and new demand increases?

Background

I’ve written a number of articles on the topic of supply and demand for ICP and now it’s time to bring it all together in order to discuss the potential future of ICP. For a walk down memory lane, you can read up on my articles on supply and demand for ICP fees, computation, liquidity pools and staking.

As you read this article, it’s important to remember that price is set at the margin, which means total supply/demand is less important for price movements then new supply/demand.

Where we are at

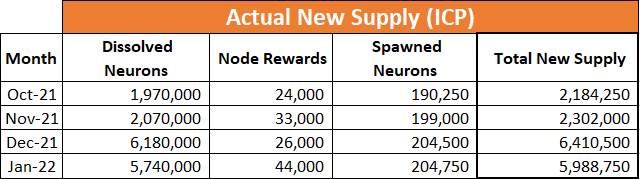

Below are tables of the supply/demand dynamics for the past 4 months. You can see the storyline of Oct21 - Jan22 has been one of dissolving neurons on the supply side and one of NNS staking on the demand side. For Spawned Neurons and Liquidity - NFT Market, I’ve made a few assumptions spelled out at the end of this article. The rest of this data should be actual results with rounding.

Where we are going

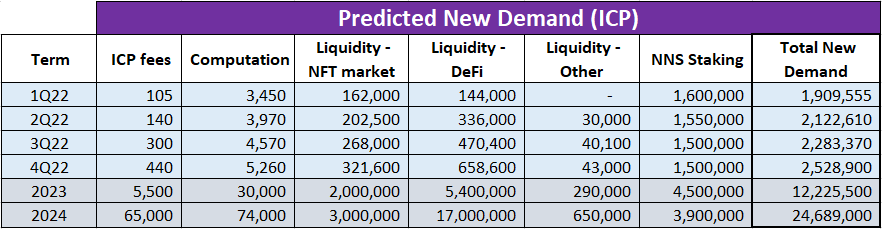

There’s really not a lot to say regarding the past few months that I haven’t already stated in the articles linked above. Where things get interesting is when we look to the future. On the supply side, if you read the Supply Analysis article you know that the first half of 2022 is challenging as a lot of ICP is dissolving off the NNS. However, starting in May 2022, the new supply drops and continues to drop through 2024 until it reaches almost 0. Below is a prediction from me on what the next three years will look like (2022 broken down by quarters, 2023 and 2024 by year). I feel confident that the total supply numbers will be accurate to within +/- 10% because supply in the medium term has been relatively predictable.

Demand gets a lot harder to predict because so much is uncertain in the Internet Computer right now. But, I tried to make a few projections based on my belief that:

DeFi will grow massively in the next 36 months.

NFT total market will continue to grow by about 10%/month

NNS staking will remain around historical trends (perhaps with a slight decrease due to ICP price appreciation).

Below is how I see demand playing out over the next three years. In terms of my confidence level, I think I could be off by as much as a magnitude or order.

I tried to set my bullish-ICP beliefs aside in making the above predictions. If anything, I fear I’ve understated the potential of DeFi liquidity on the Internet Computer. The main point I want to drive home is that I anticipate new demand for ICP to increase drastically over the next three years. Couple that with a decline in new supply and it seems reasonable to expect medium term price appreciation of ICP. In fact, if the above predictions prove correct, we could see ICP become deflationary (in terms of circulating supply) by the end of 2024.

So far, the price of ICP has tracked really well with the new supply and demand of ICP. If we apply a simple regression on supply/demand dynamics and ICP price, here is what that would look like on the predictions above. (Note - the only thing more foolish than predicting market price, is making investment decision based on someone’s predictions… don’t be a fool by betting your money on my predictions).

I include a price prediction above because I want to stress the non-linear relationship that exists between net change in new supply/demand and price, particularly to the upside. Again, it seems reasonable to assume that new supply continues to decrease into 2025 and new demand continues to increase, so it’s likely 2025 will be a fantastic time to own ICP!

What’s Next

I will use the above figures as my baseline prediction and adjust as needed moving forward. I will also be adjusting my price regression model as we build a bigger price history data set. I will send updates via this newsletter occasionally, so be sure to subscribe. I’m also toying with the idea of offering a paid-subscription, with more frequent and more detailed updates, but haven’t committed to anything yet. If you have opinions on a paid-subscription, let me know @kylelangham (Twitter) or @kyle_l (Distrikt).

Comments below are always appreciated!

Assumptions:

The liquidity pool for NFT marketplaces is equal to 50% of total monthly volume.

30% of disbursed governance rewards are spawned neurons (70% is merged maturity).

Hey Kyle- love your analysis- much appreciated! It's helpful in seeing the big picture

Thank u Kyle