Demand Driver - Liquidity Pools

How liquidity pools will be THE story of 2022

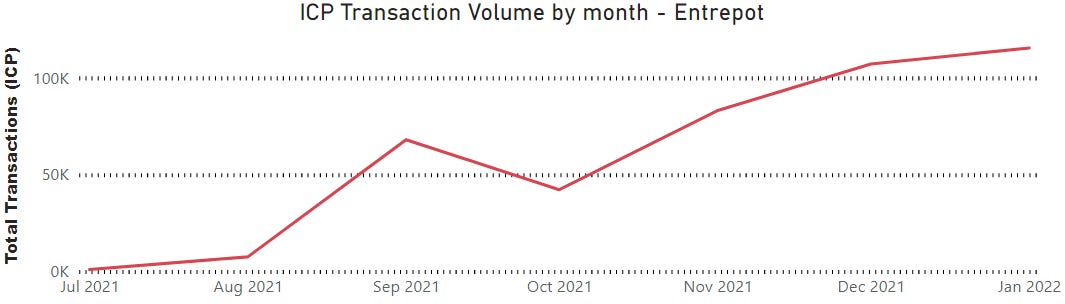

Entrepot did over 100k ICP in transactions in January. That’s a big number (!), but how does it impact demand for ICP? Read on to learn…

Background

All markets require a liquidity pool for the market to operate efficiently. The easiest way to understand a liquidity pool is as the currency that lives within a closed market at any given time for the purpose of making transactions easier within that market. ICP currently has three markets that have liquidity pools: (1) crypto exchanges like Coinbase, Hubio and Binance, (2) Entrepot, an NFT market that uses ICP as its medium of exchange and (3) Sonic, an automated market maker that allows users to add their tokens to a liquidity pool for AMM transactions. Anyone interested in the price of ICP should be interested in increasing liquidity in non-exchange pools, because doing so necessarily reduces the amount of ICP supply in the crypto exchanges.

A deeper dive into Entrepot will show how liquidity pools work and give an idea of how big of a driver for ICP demand they can be. Entrepot facilitated over 100k ICP in transactions in January. In order for that scale of transactions to occur, the users of Entrepot need to have ICP within their Stoic or Plug wallets either because they are preparing to purchase an NFT or they have recently sold an NFT and haven’t moved the ICP proceeds yet. The total ICP within the Stoic and Plug wallets of Entrepot users could be considered the size of the Entrepot liquidity pool. The size of the liquidity pool is most likely a fraction of the monthly transaction volumes at Entrepot (side bar – if you know of any resources for predicting the size of a liquidity pool based on transaction volume, I’d love it if you reached out to me) and will grow or shrink as the transaction volumes grow or shrink. The important thing to remember though is that ICP within a liquidity pool is ICP that is not on exchanges and is a clear sign of demand for ICP.

Where we are at today

Over the past five months, the amount of ICP transaction volume at Entrepot has grown rapidly as seen in the chart below. This growth has resulted in a growth in the amount of ICP brought into the Entrepot liquidity pool and if Entrepot continues to grow it should result in a larger liquidity pool. If we assume a liquidity pool of 25% of monthly transactional volume is required for efficient market operations, then about 25k ICP is currently sucked into the Entrepot liquidity pool, and that number is growing quickly. In addition, as additional NFT marketplaces are brought to the IC ecosystem, they too will have their own liquidity pools. NFT marketplace liquidity pools could become a large source of demand for ICP.

However, liquidity pools are not limited to NFT markets. In fact, a much larger potential ecosystem of liquidity pools is Defi, which could see products like Sonic, ICSwap and InfinitySwap each having transaction volumes in the millions of ICP per month, producing extremely large liquidity pools for ICP. DeFi could produce a variety of different types of liquidity pools as well, including:

Automated Market Maker (AMM) liquidity pools - ICP tokens provided to bridge the bid/ask spread of buyers and sellers of various ICP crypto pairs (for example, ICP-BTC).

Collateral - ICP set aside to provide collateral for loans provided by DeFi apps.

Token liquidity pool - ICP burned to produce another token that is then placed in a swap pool. This could become more important as the SNS comes online.

I’ll focus specifically on the last use case above (since the other use cases haven’t been deployed on the IC), but know that all three of these use cases (as well as more exotic DeFi innovations) may play a large roll in ICP demand in the next few years.

Sonic (sonic.ooo) launched on 21JAN22 and, in it’s MVP launch, includes the ability to burn ICP into either XTC (cycles) or WICP (wrapped ICP) and then to provide both as a liquidity pair. While I can’t see how much liquidity is in the XTC-WICP pool, I can see how much ICP has been burned to create XTC and WICP (and that amount has been a big conversation point on Twitter recently). As of 04FEB22, a total of 35.4k ICP has been burned on the Sonic platform, an average of 2360/day. And while it could be said that much of this ICP burn is experimentation and/or a “flash in the pan”, so far the burn rate is continuing, as shown below.

Where we are going

I believe liquidity pools of all types will be the story of 2022, along with staking, but it’s hard to predict how things will play out. Instead, let me make some predictions, in order of how confident I am in the prediction:

High confidence: Entrepot’s liquidity pool will continue to grow and additional NFT marketplaces will launch, creating additional NFT-related liquidity pools.

If Entrepot’s transaction volume continues to increase by 10% per month, they will end the year with over 310k ICP in transactions per month!

High confidence: Bitcoin and Ethereum integrations will result in large ICP liquidity pools for AMM activities.

An ICP-BTC pair that captures 0.1% of bitcoin market cap would require $750M on the ICP side… that would require almost 8% of all minted ICP coins at today’s ICP price.

Let’s say that Sonic continues to burn ~2,400 ICP burned per day (remember, the current application is the minimum viable product, so this seems reasonable throughout the year) that would equate to 72k ICP/month, which is greater than the current node reward average.

Medium confidence: Non-NFT, non-DeFi liquidity pools will pop up in 2022. I’m not sure what these will look like (maybe apps charging their fees in ICP, trading websites like eBay that use ICP as the medium of exchange, etc.) but I feel confident 2022 bring a few more use cases for ICP as a medium of exchange and unit of account.

Low confidence: Liquidity pools will make ICP deflationary by the end of the year. We would need to reach about 3.2M ICP burned or locked into a liquidity pool per month for ICP to be deflationary. This is possible by the end of the year only if marketplaces (like Entrepot) grow massively to the scale of tens of millions of ICP in transaction volume and/or if DeFi ends up locking millions of ICP per month.

Keep an eye on

Keep an eye on marketplace activity on Entrepot, particularly increases in transaction volume for the largest NFT collections. Also keep an eye on burn rates of ICP and ICP fees from The ICA Dashboard. Liquidity pools will be something I’m monitoring frequently and will update the community through this newsletter, so if you have an interest in this topic, click the subscribe button (it’s free!) below. Also, feel free to ask any questions in the comments section.

Next demand topic: Staking.

P.S. I have a conclusion article in mind where I lay out the supply and demand dynamics side by side and discuss possible impacts on ICP price in the short, medium and long term. More to come!

Gr8 read!

I really enjoy all of Kyle's articles - the economic analysis is always interesting & the I find the balanced range of predictions very useful. Thanks Kev-Dog